Please provide your information and submit this form. Our team will be in touch with you shortly.

Insurance Analysis

PROTECTING THOSE WHO MATTER MOST

PRESENTATION

0 out of 15

0 out of 15

Life insurance has the potential to offer protection at a crucial time for those who matter the most to us. Life insurance needs are different at different times in life. During working years, life insurance may be able to help your loved ones avoid drastic changes in lifestyle in the event of your passing. During retirement, life insurance can be positioned to offer additional tax and estate benefits. Regardless of your life stage, consider reviewing your life insurance needs annually to account for changes in your family situation.

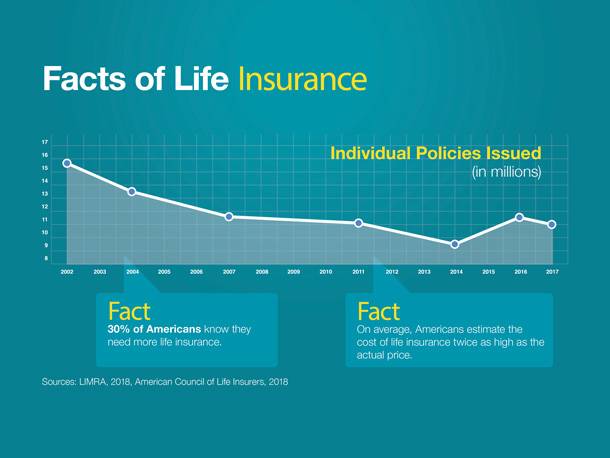

Let’s begin with a quick look at the facts of life insurance.

About 50 million households—roughly 40%—say they need more life insurance.

The numbers bear this out. In 2002, 15.0 million individual life insurance policies were issued. In 2017, only 10.5 million were issued. This drop in the number of policies may have many causes, but the result is fewer families with the protection of life insurance.

One reason may be that people vastly overestimate the cost of life insurance, believing, on average, that it costs three times as much as it actually does.

Several factors will affect the cost and availability of life insurance, including age, health, and the type and amount of insurance purchased. Life insurance policies have expenses, including mortality and other charges. If a policy is surrendered prematurely, the policyholder also may pay surrender charges and have income tax implications. You should consider determining whether you are insurable before implementing a strategy involving life insurance. Any guarantees associated with a policy are dependent on the ability of the issuing insurance company to continue making claim payments.

Sources: American Council of Life Insurers, 2018; LIMRA, 2018

It is easy to view life insurance as an obligation rather than an opportunity—and an obligation that can be put off at that. But life insurance offers many benefits.

We all know life insurance can provide funds to pay your last expenses—including estate taxes and other costs. Life insurance potentially may be able to replace your income and help to maintain your family’s standard of living after you die.

In addition, life insurance may be able to protect your family’s home by paying off the mortgage and other debts.

The proceeds of a life insurance policy can be used to pay others to do some of the tasks you do routinely, such as caring for an aging relative or a child.

Life insurance has the potential to ensure that your children or grandchildren have the funds to go to college.

Life insurance can provide supplemental retirement income for your spouse or partner.

A life insurance policy may be able to provide funds to help settle your estate—to equalize otherwise unequal gifts to children, for example.

And life insurance can be used to pay expenses incurred to keep your small business in the family.

To understand life insurance, you need to understand the answers to three questions:

First, how does it work? How does life insurance function, step by step?

Second, how much do you need? How much insurance coverage will it take to meet your obligations?

And third, what are your life insurance options?

First, how does life insurance work?

Life insurance is a contract between you and an insurance company. Under this arrangement, the insurance company agrees to pay your beneficiaries a specific amount of money when you die. In return, you agree to pay a premium—either as regular payments or as a lump sum. Remember, any guarantees associated with a policy are dependent on the ability of the issuing insurance company to continue making claim payments.

The insurance companies have developed a number of variations on this arrangement, but it forms the basis of all insurance policies.

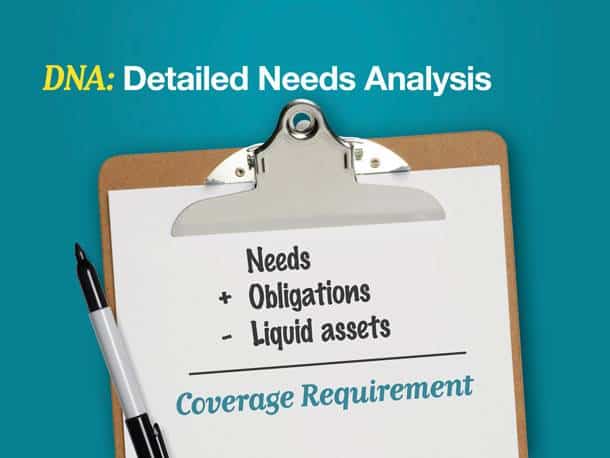

How much life insurance do you need? There are general estimates available based on multiples of income. However, if you are looking for a more accurate estimate, consider completing a “DNA test.“ A DNA test is a “Detailed Needs Analysis“ that takes into account a wide range of financial commitments to help better estimate insurance needs.

The first step is to add up needs and obligations.

Start with your family’s short-term needs. How much will it cost to cover your final expenses, such as a funeral, final medical bills, and any outstanding debts, such as credit cards or personal loans?

Next, look at your family’s long-term needs: how much will it cost to maintain your family’s standard of living? How much is spent on necessities like housing, food, and clothing? Also, consider factoring in expenses such as travel and entertainment. Answering the question, “What would it cost a year to maintain this lifestyle?“ is a good place to start.

Finally, look at your family’s future obligations. Will aging parents need some kind of support? Will children or grandchildren need help with college costs? And so on.

Next, take a hard look at your family’s liquid assets.

Liquid assets are assets that can be redeemed quickly and for a predictable price. Generally, houses and cars are not considered liquid assets since they may require time to sell and because selling them may adjust your family’s standard of living.

Needs and obligations—minus liquid assets—can help you arrive at a better idea about the amount of life insurance coverage you may need.

Keep in mind that this is just a quick exercise. While it’s a good start at understanding your insurance needs, a more detailed review may be necessary to better assess your situation.

What are your life insurance options?

All life insurance products fall under one of two broad types: term life insurance and permanent life insurance.

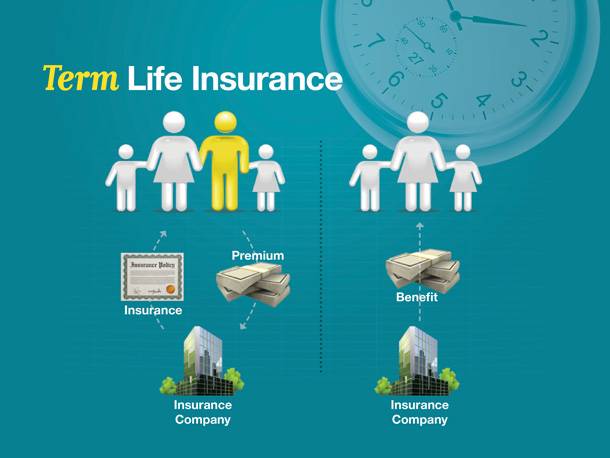

Term insurance is the simplest form of life insurance. It allows policyholders to purchase coverage for a specific period of time at a specific price. Term insurance is normally less expensive than permanent insurance.

Permanent insurance does not expire. It remains in place as long as premiums are paid.

When individuals purchase term life insurance, they pay a specific premium to buy life insurance coverage for a specific period. If the policyholder dies during that time, his or her beneficiaries receive the benefit from the policy. If he or she outlives the term of the policy, it is no longer in effect. The person would have to reapply to reinstate the coverage.

Unlike permanent insurance, term insurance only pays a death benefit. That’s one of the reasons term insurance tends to be less expensive than permanent insurance.

There are four broad types of permanent life insurance. The first of these is whole life insurance.

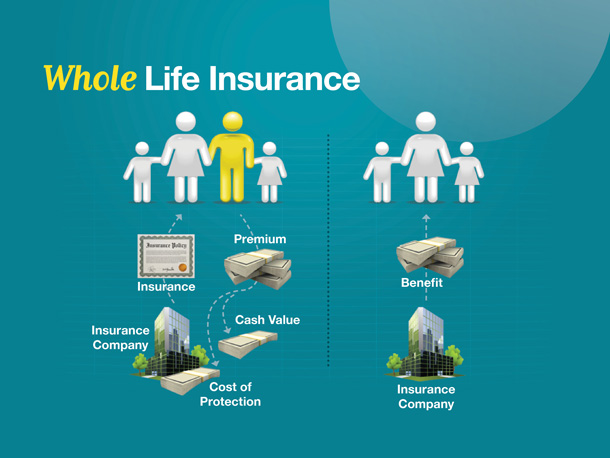

Whole life insurance is life insurance that remains in force for the policyholder’s whole life, as long as he or she remains current paying premiums. In exchange for these fixed premiums, the insurance company promises to pay a set benefit when the policyholder dies.

Unlike term life insurance policies, whole life insurance policies build up cash value—effectively a cash reserve—that pays a modest rate of return. The growth on this cash value is tax deferred.

With whole life insurance, withdrawals of earnings are fully taxable at ordinary income tax rates. If you are under age 59½ when you make the withdrawal, you may be subject to surrender charges and assessed a 10% federal income tax penalty. Also, withdrawals will reduce the benefits and value of the contract.

Universal life insurance is permanent life insurance that goes one step further than whole life insurance: it provides a flexible premium and, by extension, a flexible benefit.

That means, within certain limits, the policyholder decides how much to put in above a set minimum. This potentially raises the face value of the policy.

Like whole life insurance policies, universal life insurance policies accumulate cash value—cash value that grows tax deferred.

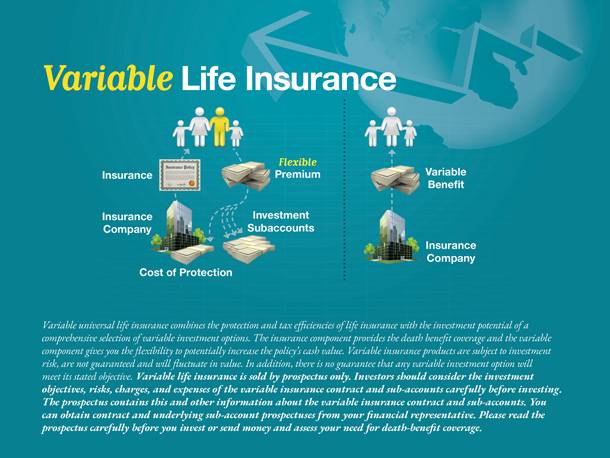

Variable universal life insurance is a form of universal life insurance. It is permanent insurance that provides a flexible premium and an adjustable benefit—meaning the policyholder decides how much to put in above a set minimum, potentially increasing the face value of the policy.

But there’s an important difference.

With a variable universal life insurance policy, the policyholder directs how premiums are invested by allocating them to one or more investment subaccounts. Depending on the policy, these subaccounts could include a fixed-interest option, as well as various stock, bond, or money-market choices. This provides access to the potentially higher returns provided by the financial markets. It also means returns could underperform those provided by other life insurance products.

Variable universal life insurance combines the protection and tax efficiencies of life insurance with the investment potential of a comprehensive selection of variable investment options. The insurance component provides the death benefit coverage and the variable component gives you the flexibility to potentially increase the policy’s cash value. Variable insurance products are subject to investment risk, are not guaranteed and will fluctuate in value. In addition, there is no guarantee that any variable investment option will meet its stated objective. Variable life insurance is sold by prospectus only. Investors should consider the investment objectives, risks, charges, and expenses of the variable insurance contract and sub-accounts carefully before investing. The prospectus contains this and other information about the variable insurance contract and sub-accounts. You can obtain contract and underlying sub-account prospectuses from your financial representative. Please read the prospectus carefully before you invest or send money and assess your need for death-benefit coverage.

Also, please remember that money held in money market funds is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Money market funds seek to preserve the value of your investment at $1.00 a share. However, it is possible to lose money by investing in a money market fund.

That raises an interesting question: should you choose a fixed or variable policy?

A fixed policy offers a guaranteed, fixed return. It’s dependable—though more conservative.

A variable policy offers some degree of investment flexibility. The policyholder allocates his or her premiums to different investment subaccounts. This gives the policyholder access to the potentially higher returns provided by the financial markets. It also means there is a risk of lower return.

Whether you choose a fixed or variable policy will depend on your individual situation. You’ll need to take into account your complete finances, including your cash reserves, your investment portfolio, and any business interests. Any guarantees associated with a policy are dependent on the ability of the issuing insurance company to continue making claim payments.

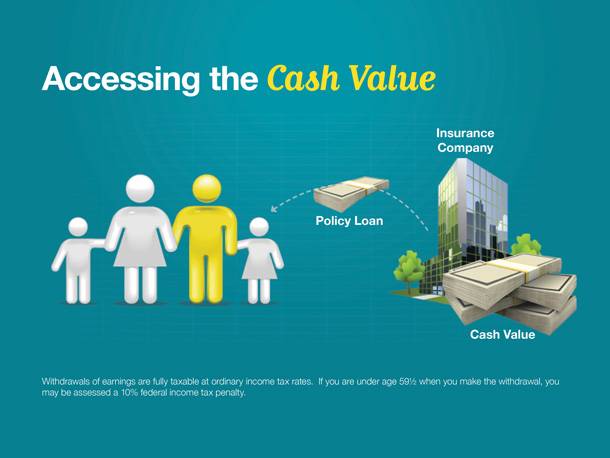

Permanent life insurance policies also offer an additional benefit: access to the cash value of the policy.

Under certain conditions, policyholders can usually borrow a portion of their policy’s cash value under fairly favorable terms. And interest payments on policy loans go directly back into your policy’s cash value.

Generally, loans taken from a policy will be free of current income taxes provided certain conditions are met, such as the policy does not lapse or mature. Keep in mind that loans and withdrawals reduce the policy’s cash value and death benefit. Loans also may increase the possibility that the policy may lapse. If the policy lapses, matures, or is surrendered, the loan balance would be considered a distribution and would be taxable.

Withdrawals of earnings are fully taxable at ordinary income tax rates. If you are under age 59½ when you make the withdrawal, you may be subject to surrender charges and assessed a 10% federal income tax penalty. Life insurance is not FDIC insured. It is not insured by any federal government agency or bank or savings association.

Life insurance offers protection in case you die when those who depend on you still need you, it also offers other estate and tax management benefits. Here are some scenarios that might be familiar:

Anthony and Selena have a growing family and wonder, “With all of our expenses, including saving for college and investing money for the future, is life insurance really necessary? How do we choose between a permanent or a term insurance policy?”

Dave and Christine are in retirement. They ask, “Now that we are retired, should we cash out our whole life policy?”

Rebecca is a single woman with a small business. She wants to know, “What are the criteria for understanding whether key employee insurance is appropriate?”

Isaac likes to do research online and has read some negative comments about universal life insurance. He asks, “Do the benefits of a universal life insurance policy outweigh the fees and expenses associated with it?”

All of these are great questions and it’s important to remember that individual recommendations will vary with each situation.