Please provide your information and submit this form. Our team will be in touch with you shortly.

Insurance Analysis

LONG-TERM-CARE PROTECTION STRATEGIES

PRESENTATION

0 out of 13

0 out of 13

Long-term care can be an expensive drain on family resources. And people might be surprised by the number of Americans who may need long-term care if current trends remain in place.

It makes sound financial sense to develop a strategy to protect yourself—and your family—should the need for long-term care arise.

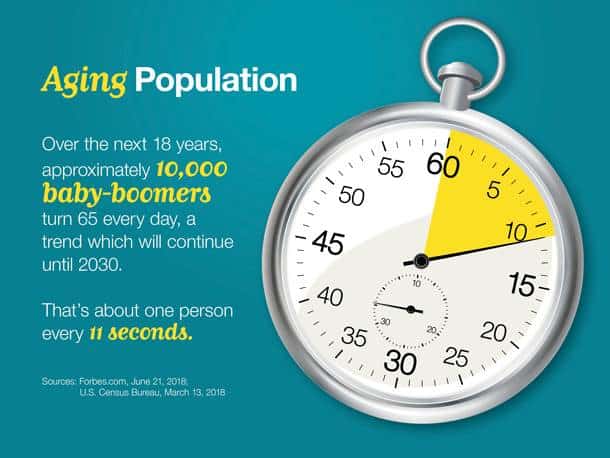

Many members of the baby-boom generation are now reaching retirement age. In fact, approximately 10,000 baby boomers turn 65 every day, a trend which is expected to continue until the 2030. That works out to about one person every eleven seconds. How fast is that? In 2020 there will be about 3 1/2 working-age Americans for every individual in retirement age. By 2060, there will be only 2 1/2 working-age Americans for every individual in retirement age.

The median age of the U.S. population is expected to grow from 38 today to 43 by 2060.

Sources: Forbes.com, June 21, 2018; U.S. Census Bureau, March 13, 2018

The aging of America brings certain challenges with it.

For example, it means that more and more people are expected to reach an age where they are likely to need some type of assistance.

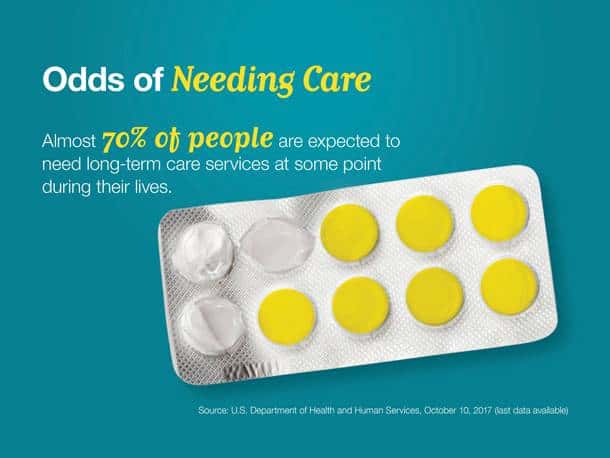

The U.S. Department of Health and Human Services reports that almost 70% of people over age 65 are expected to need long-term-care services at some point in their lives.

While it’s difficult to predict what type of care any one person might need or how long he or she will need it, statistics reveal that the average person needing long-term care will need it for about three years. Women are averaging longer, at 3.7 years to men’s 2.2 years. And 20% of us will need care for more than five years.

Source: U.S. Department of Health and Human Services, October 10, 2017 (last data available)

Since so many people over age 65 are expected to eventually need some level of long-term care it makes sense to have a better understanding about long-term care and how it works—and to consider what you can do to prepare financially.

To do that, we need to examine three key questions:

First, what is long-term care?

Second, how much does it cost?

And third, what are your long-term-care funding options?

What is long-term care?

Long-term care includes skilled nursing care — such as the rehabilitative care needed after an extended hospital stay. But that’s just one of the many types of care available.

Long-term care also includes assisted living facilities. These are environments for individuals who can no longer function independently but don’t need daily care. These facilities offer occasional help with what are referred to as “activities of daily living.” These include help bathing, dressing, eating, transferring—getting in and out of bed or wheelchair—and walking.

It can also include home health care, that is, occasional help with the activities of daily living we just listed, as well as help with meals, budgeting, house cleaning, medication management, and even transportation. In this case, however, the help is offered by hired assistants who come to your home on a regular basis.

Long-term care even includes respite care—that is an occasional break for family members who provide long-term care services.

Next question: how much does care cost?

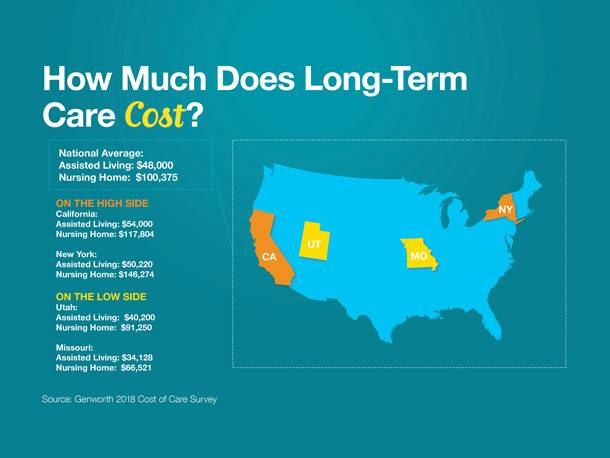

The costs vary state by state, and region by region.

The national average for assisted living centers—single occupancy—is $48,000 a year. The average cost of a skilled care facility — again, single occupancy in a nursing home — is much higher at $100,375 a year.

The price can range widely from there. Some areas—Utah and Missouri, for example—are somewhat lower than the national average for long-term-care costs. Others—like New York or California—are quite a bit higher.

Source: Genworth 2018 Cost of Care Survey

What are your options for long-term care? There are many, however your primary choice is between two options: self insure or purchase long-term-care insurance.

Let’s go through each.

Self insure involves depending on personal savings and investments to fund any long-term-care needs. This would give you complete flexibility but require that you be prepared for the potential expense.

Remember, the national average for assisted living centers is $48,000 a year and the average cost of a skilled care facility is $100,375 a year.

In fact, self insure is a choice many make by default—simply because they haven’t planned for long-term-care expenses at all.

But as you will see, self insuring has consequences.

Self insuring may have an impact on your overall retirement strategy.

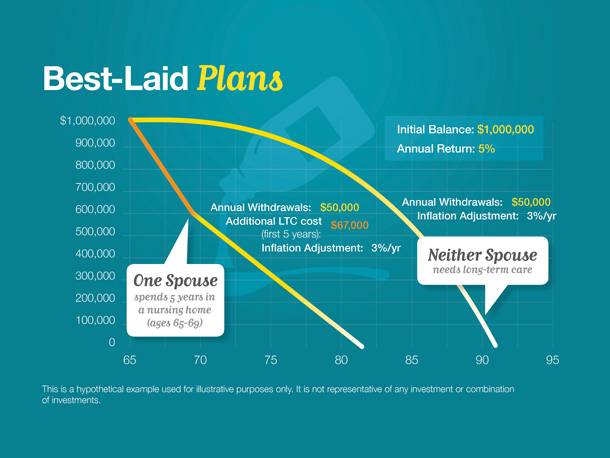

This chart shows a $1 million retirement portfolio generating a hypothetical 5% rate of return. It assumes a 65-year-old couple will be withdrawing $50,000 per year, adjusted upward by 3% each year to account for inflation.

If all goes as planned, their retirement portfolio has the potential to provide income until the couple reaches age 92.

If, however, one spouse spends the first five years of his or her retirement in a nursing home, the portfolio’s income potential changes. The hypothetical example assumes the couple will spend $117,000 a year, adjusted upward 3% each year for inflation, during the five years while the spouse requires long-term care.

As you can see, if they make no changes, their funds will be exhausted by the time they reach 83 years old.

One question that naturally arises is: what about Medicare?

Medicare offers only a partial solution to the long-term care problem.

Medicare actually does cover some skilled nursing home care, under very tight restrictions. You have to have stayed in a hospital for three days first and be discharged directly to a skilled nursing facility.

However, Medicare does not pay for custodial care.

Under these conditions, Medicare will cover the first 20 days completely. For the next 80 days, it will cover all but a deductible. And after 100 days, it doesn’t cover anything.

This assumes, of course, that you find a skilled nursing facility that accepts Medicare, and you meet the other conditions Medicare imposes.

Source: Medicare.gov, 2018

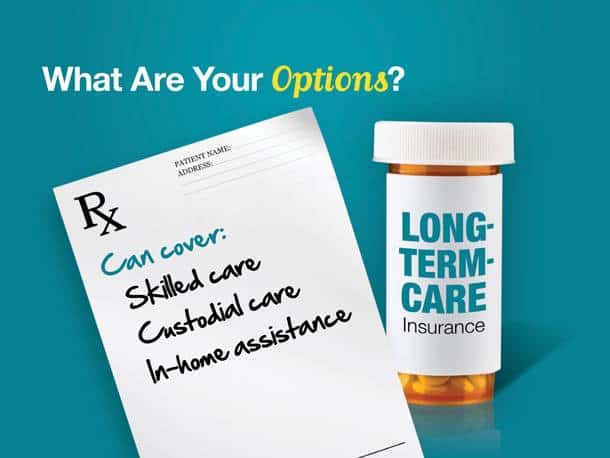

Your other option is to transfer the financial risk of long-term care to an insurance company through long-term-care insurance.

A long-term-care policy can cover all levels of care, from skilled care to custodial care to in-home assistance. Many find it to be an appropriate way to protect themselves and their loved ones from the potentially devastating cost of long-term care.

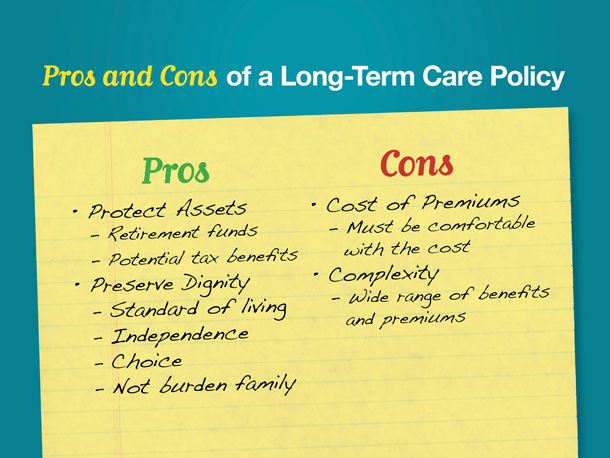

There are a number of pros and cons of long-term-care policies.

On the pro side of the ledger, a long-term care insurance policy can protect your assets. You won’t need to dip into your retirement funds to cover the cost of care. And under certain conditions, your premium may be partially or completely deductible.

Long-term-care insurance offers other advantages. In the event of a long-term illness, it will enable you to preserve your dignity. You can maintain your standard of living and, for as long as possible, your independence. You can preserve your choice. And you can keep from becoming a burden to your family.

On the con side, you need to be sure you are comfortable with the cost of premiums. It wouldn’t make sense to pay premiums for a number of years, only to let the policy lapse because the premiums push your budget too far.

Long-term-care insurance also can be fairly complex. Policies offer a wide range of benefits for which they charge a wide range of premiums. It’s critical to take a close look before committing to a policy, or to work with a professional who understands what to look for.

When choosing a long-term-care policy, what do you need to bear in mind?

First, make sure you understand the limitations and features of the policy you’re considering. In most cases, policyholders cannot collect benefits until their disability reaches certain levels. And most policies specify how much they will pay for each day of care and for how long.

Second, take a close look at the type of care covered. Long-term-care policies can cover everything from skilled care in a nursing home to periodic custodial care in your home. You need to understand exactly what is covered and what is not.

Third, look at the total benefit. You don’t want a policy that will run out of benefit just when you need it most. And you don’t want to pay for coverage you’re unlikely to need.

Look at the waiting period before benefits are scheduled to begin.

You want a policy that’s renewable.

Consider inflation protection. The cost of health care has been rising more rapidly than the general rate of inflation. It won’t help to have a policy that falls behind rising healthcare costs.

And finally, consider a policy with waiver of premium. This means your premiums are discontinued once you start drawing benefits.