Please provide your information and submit this form. Our team will be in touch with you shortly.

In continuing our series during this open enrollment period, we are going to look at a couple of ways to save for qualified medical expenses. Two of the most common vehicles used for medical expense savings is through Flexible Savings Accounts (FSAs) and Health Savings Accounts (HSAs). Both plans provide you with the ability to contribute pre-tax dollars into an account that can be used for qualified medical expenses such as dental care, vision care, and prescription expenses tax-free.

Qualifications

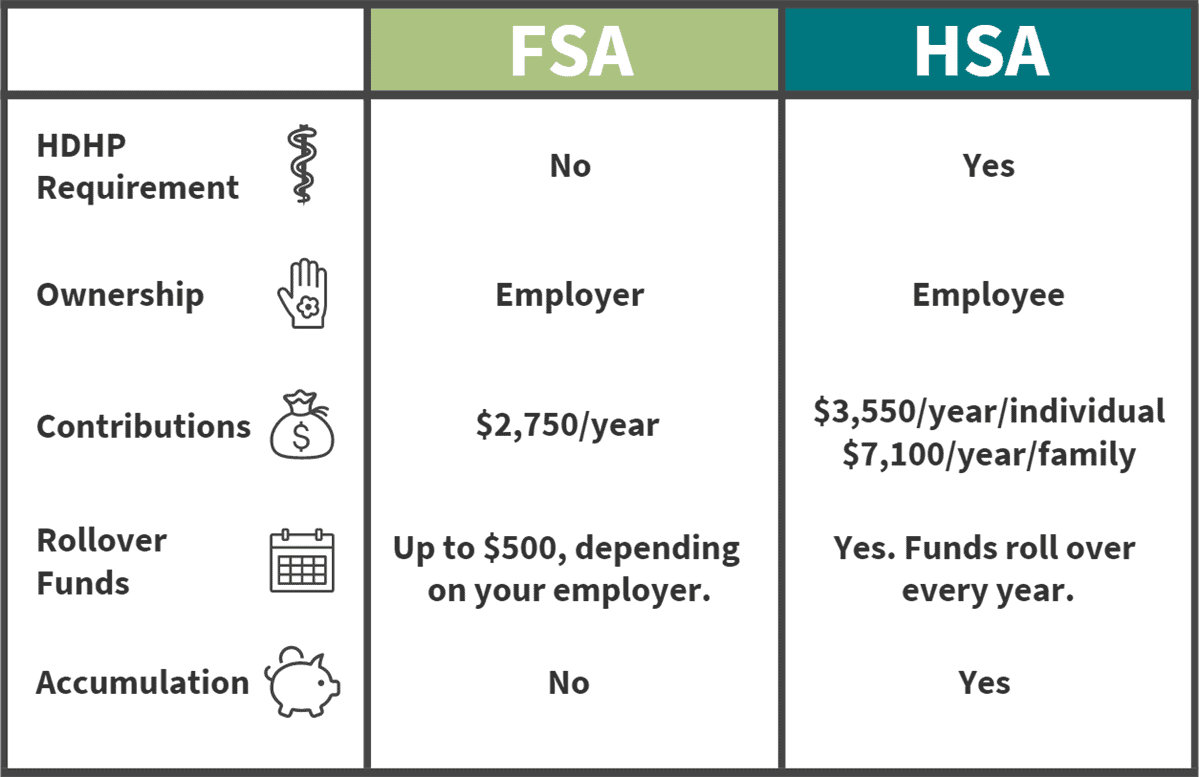

The first major distinction between FSAs and HSAs include the eligibility requirements for getting the plan. FSAs must be set up by your employer. This means that self-employed and unemployed individuals are not eligible.

HSAs on the other hand are available to self-employed individuals but have a few more requirements. With an HSA, you must have a High Deductible Health Plan (HDHP) in place. An HDHP is a health insurance plan that typically has higher deductibles than a traditional health insurance plan, but the monthly premiums are usually lower. In addition, you cannot be eligible for Medicare or be claimed as a dependent on another person’s tax return in order to qualify for an HSA.

Ownership

Because your employer is the one who offers you an FSA, your employer technically owns your FSA account. If you were to change jobs, your FSA will not follow you unless you are eligible for FSA continuation through COBRA. Conversely, an HSA is set up by you, so the ownership of the account remains with you and follows you if you change employment.

Contributions

The contribution limit in 2020 for FSAs is $2,750 per year to your account. HSA contribution limits are higher, allowing $3,550 per year for an individual and $7,100 per year for family coverage. Those who are over the age of 55 are allowed an additional catch-up contribution of $1,000 to an HSA.

An important thing to keep in mind about these accounts is that HSAs provide more flexibility when it comes to changing your contribution for the year. With an HSA, you can change your annual contribution amount anytime, as long as it does not exceed the yearly limit. With FSAs, your contribution typically can only be changed during open enrollment or if you have a change in family status (marriage, divorce, birth of a child, etc.).

Rollover Rules

Rollover Rules

Perhaps the biggest differentiator between FSAs and HSAs is the ability of funds to rollover or not. With HSAs, the funds you put into the account will roll over every year, allowing you to save for the long-term. On the other hand, FSAs historically have been known by the phrase “use it or lose it.” If you don’t use the funds in the account for that year, the money does not roll over to the next year. Due to a recent change in FSA rules, your FSA plan may allow up to $500 of unused funds to rollover and/or allow a short grace period for you to use the funds in the plan before they expire for that year. Both provisions depend on your employer.

Tax Savings

For both FSAs and HSAs, you can contribute with pre-tax dollars and distributions for qualified medical expenses are tax-free! With HSAs, your contributions are tax deductible which provides a great tax benefit. Another benefit of HSAs is that you can invest in these accounts and achieve long-term growth because the funds are able to accumulate and grow tax deferred.

Penalties

For FSAs, you may need to submit your medical expenses to your employer in order to be reimbursed. If the medical expense is not a qualified medical expense, you may not be given the funds, depending on your employer.

HSAs allow tax-free distributions for qualified medical expenses. If the funds are used prior to age 65 for non-medical expenses, the funds will be subject to income tax and a 20% penalty. After age 65, you can use the funds for non-medical expenses without being subject to the 20% penalty, but you would be subject to tax.

We hope that this information is helpful to you during this open enrollment period! Feel free to reach out to us if you have any questions regarding FSAs or HSAs in your financial plan. Please note that this information does not address Dependent Care FSAs. This information is not intended to be a substitute for specific individualized advice, and we suggest you discuss your specific situation with a qualified financial advisor.

https://www.valuepenguin.com/banking/difference-between-fsa-and-hsa

https://www.healthcare.gov/glossary/high-deductible-health-plan/

https://www.connectyourcare.com/tools/eligible-expenses/