Please provide your information and submit this form. Our team will be in touch with you shortly.

If you work at a publicly traded company, you may be given employer stock or the opportunity to purchase employer stock in your retirement plan, most commonly in an ESOP or 401k plan. Typically, the funds in your retirement account grow tax-deferred, and when you take a distribution the funds are taxed as ordinary income. In the case of an individual with a retirement account that contains employer securities, the IRS has allowed for what’s called Net Unrealized Appreciation, otherwise known as NUA. This special tax treatment allows for you to tax advantage of long-term capital gains rates, which are more favorable than ordinary income tax rates. In this article, we are going to look at the requirements of NUA, how it works, and the advantages and disadvantages of electing this special tax treatment.

To make the NUA election, there are several requirements that must be met:

- There must be an in-kind distribution which means you must directly transfer the employer stock to a taxable investment account. If you sell the shares within your 401k and then rollover the proceeds to an IRA, you lose your ability to take advantage of NUA.

- You must take a lump-sum distribution, which means you must distribute the entire account balance in the year you take an NUA distribution. This means that in addition to transferring out the employer stock in-kind, the remaining balance must either be distributed as a taxable withdrawal or rolled over as well.

- To qualify for NUA treatment, the in-kind, lump-sum distribution must be made on account of death, disability, separation of service, or reaching the age of 59½. If your qualifying event is separation from service, you may be subject to an early withdrawal penalty prior to age 59½. If you separate from your company at age 55 or later, you may make a penalty-free distribution from that employer’s 401k prior to age 59½. Note that any past employer 401ks are not eligible for the same penalty waiver.

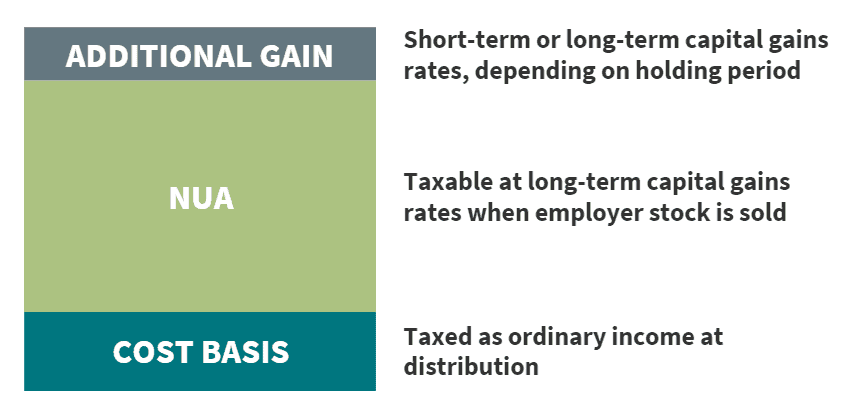

Like we mentioned earlier, funds in a retirement plan are typically taxed at ordinary income rates when distributed. When an NUA distribution occurs, the cost basis of the employer securities is taxed as ordinary income at distribution. The appreciation (the difference between the cost basis and fair market value at distribution) is taxed at more favorable long-term capital gains rates. While the ordinary income tax on the cost basis occurs at distribution, the long-term capital gains tax on the appreciation doesn’t occur until the employer stock is sold. If you end up holding the employer stock beyond the date of distribution, the additional appreciation will be taxed at either short-term or long-term capital gains rates depending on the holding period, which starts at the date of distribution.

Like we mentioned earlier, funds in a retirement plan are typically taxed at ordinary income rates when distributed. When an NUA distribution occurs, the cost basis of the employer securities is taxed as ordinary income at distribution. The appreciation (the difference between the cost basis and fair market value at distribution) is taxed at more favorable long-term capital gains rates. While the ordinary income tax on the cost basis occurs at distribution, the long-term capital gains tax on the appreciation doesn’t occur until the employer stock is sold. If you end up holding the employer stock beyond the date of distribution, the additional appreciation will be taxed at either short-term or long-term capital gains rates depending on the holding period, which starts at the date of distribution.

It is important to note that NUA is a choice, not a requirement. It may be beneficial for some and non-beneficial for others, depending on your specific situation. The upside if that you can take advantage of long-term capital gains rates on a portion of your retirement plan, instead of ordinary income rates. The downside is that you are paying a large amount of tax sooner, rather than spread out over time. It is also important to consider how much your cost basis of employer stock is; if it’s a very high cost basis and/or there isn’t a significant amount of appreciation, it may not be beneficial to utilize NUA.

If you have any questions about how NUA could be beneficial to you, please feel free to reach out to us! This information is not intended to be a substitute for specific individualized advice, and we suggest you discuss your specific situation with a qualified financial advisor.