Please provide your information and submit this form. Our team will be in touch with you shortly.

Anyone who has ever been on a commercial flight has heard the words: “We’re experiencing some turbulence, so the captain has turned on the seat belt sign. Please return to your seats and fasten your seat belt.” Most of us probably groan when we hear these words; after all, nobody enjoys a rough ride. But we also realize that our safety and comfort is best served by following the crew’s instructions, buckling in, and riding it out until the aircraft reaches smoother air.

During the third quarter of 2024, the US stock markets entered some “rough air.” Though showing a strong upward trend for most of the year, in early August a series of jolts roiled the markets, propelling the Cboe VIX index, a popular measure of market volatility, to its highest level since the COVID-19 pandemic. The S&P 500 dropped more than 6% from the end of July to early August in a swoon caused by a weak jobs report and a spate of disappointing corporate earnings reports. These data triggered worries that the Fed had waited too long to start cutting interest rates, and that a recession could be imminent.

With the benefit of hindsight, we know that by mid-August, the S&P 500 had recovered the lost ground, and by the end of the month, the index was at a new all-time high. After another 4% drop in early September, the index finished the month at or near another all-time high.

When you think about the swoops and climbs described above, it’s reminiscent of a rollercoaster ride. While we all know that part of the thrill of a rollercoaster are the sudden and dramatic drops, it’s less fun to feel like you’re on a financial rollercoaster.

But once again, remember what the attendants tell you when they’re putting you on the ride: “Keep your arms and legs inside the compartment and remain in your seat until the ride comes to a complete stop.” Just as you wouldn’t attempt to get off a rollercoaster while it’s in motion, it’s usually not a good idea to react to market volatility by making dramatic, emotion-driven changes in your portfolio.

It also helps to remember that history is on the side of those who take a long-term perspective. Especially for goals like retirement and even education funding, investing is more like a marathon than a sprint. Research also indicates that short-term volatility is not strongly correlated with long-term market returns. So, while increased volatility is likely to make some investors a bit “airsick,” it’s usually not a good idea to run for the sidelines. As a matter of fact, being out of the market at the wrong time can be very detrimental to portfolio performance.

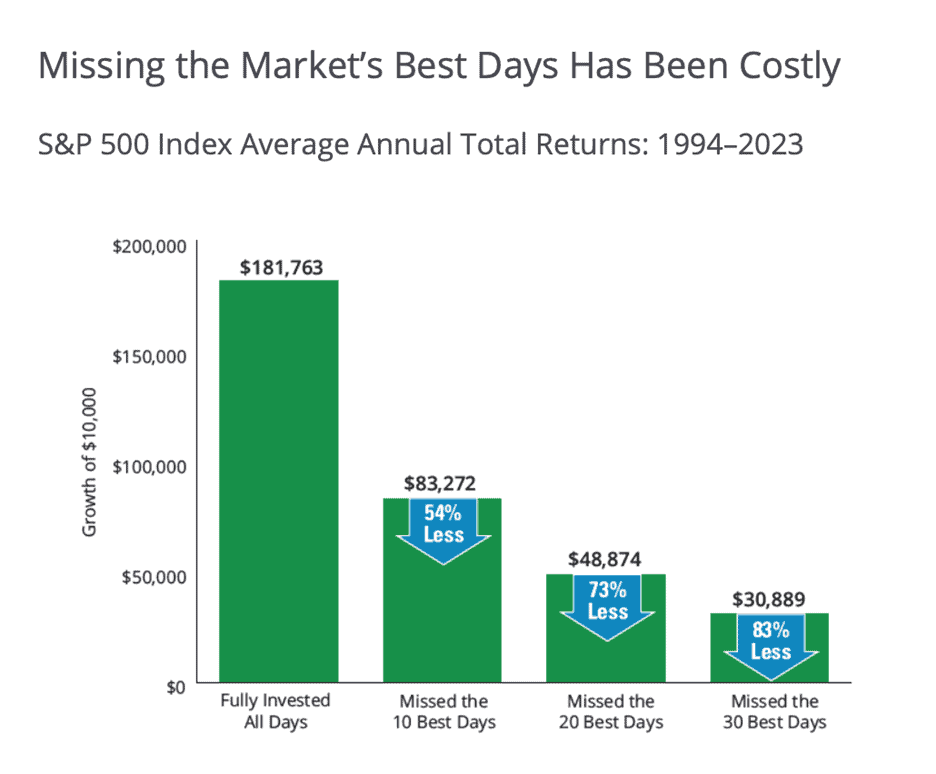

SOURCE: Morningstar, Hartford Funds, Ned Davis Research. Past performance is no guarantee of future results; indexes are not available for direct investment.

As the chart above illustrates, it makes a big difference to overall returns if an investor happens to be “on the sidelines” when the market is making a major move upward. Those who remained fully invested throughout the ups and downs enjoyed substantially greater returns than those who, perhaps driven by the fear of experiencing a sudden drop, pull out of the market to “wait things out.”

What all this points out is the value in a popular market proverb: “Timing the market is a poor substitute for time in the market.” In fact, attempts to time the market typically result in worse long-term results. This is because short-term market movements—in either direction—are inherently unpredictable, so picking the “right” time to get in or out is virtually impossible with more than random accuracy.

Given all this, what should the average investor do? Our advice remains the same: Stick to what you can control—appropriate asset allocation, proper diversification, and systematic rebalancing. By building a portfolio of broadly diversified assets that are appropriate for the investor’s tolerance for risk, and by rebalancing to keep the assets in the correct proportions, an investor can generally expect to do well over the long term. While these three keys will not eliminate volatility, they will generally function to make the ride a bit less bumpy, while encouraging the investor to “stay in the seat” until things are smoother.

The other thing that can make the ride more comfortable is having the assistance of a professional, fiduciary financial advisor. At Aspen Wealth Management, we know that our clients need authoritative, objective guidance that is based on sound research and professional experience. As we help clients create financial strategies tailored to their individual needs and goals, our fiduciary obligation means that everything we do is driven by what is in the client’s best interest. To learn more, subscribe to our free Alexa skill, “Purposeful Planning.”