Please provide your information and submit this form. Our team will be in touch with you shortly.

It’s that time of year again- open enrollment! Open enrollment is a period of time during the year that you get to enroll or change your health insurance benefits. Texas open enrollment runs from November 1st to December 15th, and you can find a list of open enrollment dates specific to your state here. This is the only time of the year that you get to make these choices, and you can’t change your benefits outside of this open enrollment period unless you have a qualifying event such as the birth of a child, marriage, divorce, or death. The options you have may be overwhelming, so if you’re looking to learn more about how different health insurance benefits can be a piece to your financial plan, this series is a great place to start.

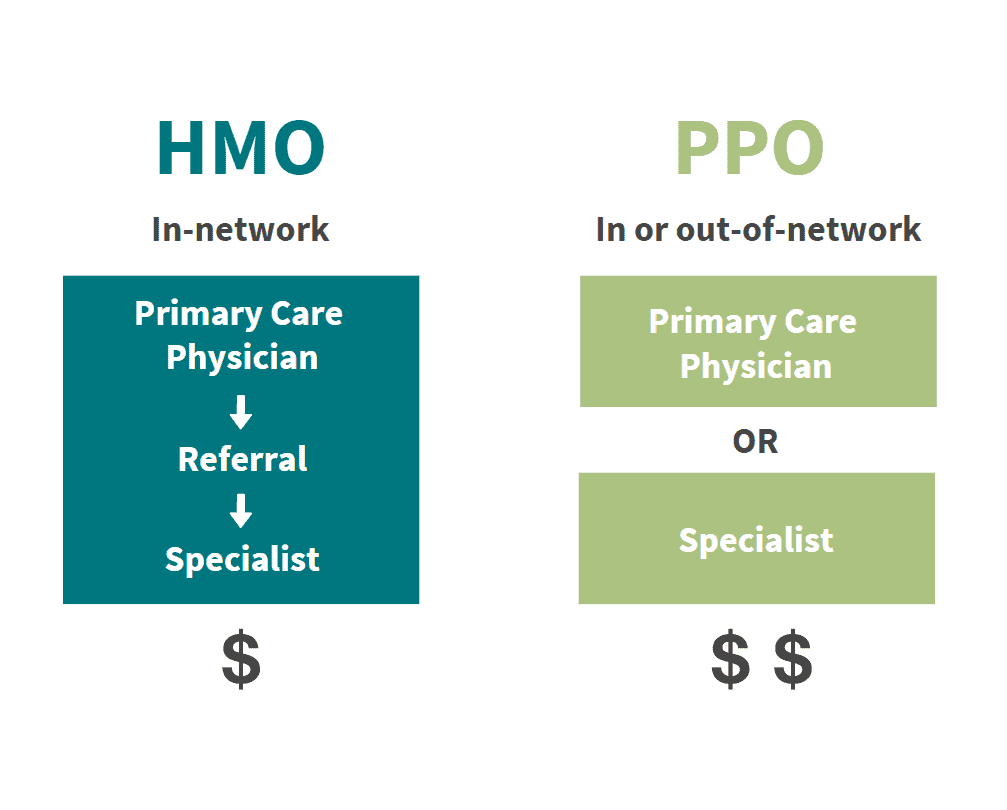

In this first series, we are going to go over the main differences between a Health Maintenance Organization (HMO) and a Preferred Provider Organization (PPO).

Networks

One of the main differences between HMOs and PPOs is the flexibility of network providers. HMOs give you access to doctors within a specific network and you are covered if you stay within that network, unless there is a medical emergency or have prior approval. On the other hand, PPOs provide more flexibility because of fewer restrictions on out of network providers.

Primary Care Physicians

Another distinction between HMOs and PPOs is the requirement of a Primary Care Physician (PCP). HMOs require you to choose a PCP who will be the primary person to manage your medical needs. If you need to see a specialist, you will have to go to your PCP who will then refer you to someone else if they deem necessary. If you don’t receive a referral from your PCP to see a specialist, the cost is typically not covered. PPOs are much more flexible because they do not require you to utilize a PCP and you are able to choose a specialist while still being covered.

Cost of Coverage

For both HMOs and PPOs, seeing providers inside your network is much more cost effective. If you do go outside of your network, HMO coverage will be more expensive than going outside of your network with a PPO.

Considering PPOs provide more choice and flexibility, they typically have higher premiums and higher deductibles than HMOs. Depending on your current situation, it is important to weigh the costs and flexibility these plans offer to better help you decide which is best!

Everyone’s financial situation is different. Feel free to reach out to us if you have any questions about how either of these benefits can be a piece to your financial plan. This information is not intended to be a substitute for specific individualized advice, and we suggest you discuss your specific situation with a qualified financial advisor.